missouri gas tax refund

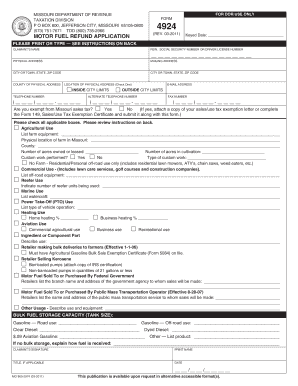

Tax Refund Application must be on file with the Department in order to process this claim and may be submitted at the same time as Form 4923. Fridays increase will bring Missouris gas tax to 195 cents.

/cloudfront-us-east-1.images.arcpublishing.com/gray/ENON6OIQKBHMDEO73MYRMAF7X4.jpg)

Irs 1 5b Available In Tax Refunds From 2018 Window Closing For Those To File

New App Enables Missouri Residents to Get Tax Refunds for Gas.

. Senate Bill 262 you may be eligible to receive a refund of the 25 cents tax increase you pay on Missouri motor fuel in vehicles weighing less than 26000. 1 2022 and will then. Refunds must be filed on or after July 1 but not later than September 30 following the fiscal year for which the refund is claimed.

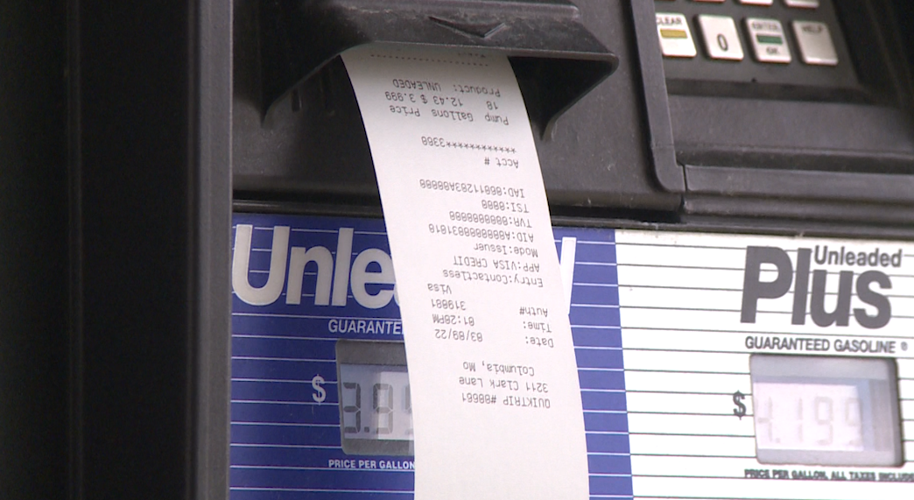

With the average gas prices remaining around 381 in Missouri everyone is looking for methods to save money at the pump. Missourians will be eligible to receive their first refund on July 1 2022. Once fully implemented in 2025 the tax increase is expected to.

This Non-Highway Use Motor Fuel Refund Application Form 4924 must be completed to substantiate your refund claims. Vehicle weighs less than 26000 pounds. Mike Parson in July raises the price Missouri drivers pay on gasoline by an additional 25 cents per gallon every year until 2025 for.

Form Print Form Missouri Department of Revenue Motor Fuel Refund Claim Form Office Use Only Keyed Date Document No r FEIN r Social Security Number r Driver License Number Name City Claimant Mailing Address Phone Number Alternate State ZIP Code Fax Number - E-mail Address Avg Price Per Gal Gasoline See instructions The refund claim must be filed within one year of. And cashing in on Missouris new tax-refund regulation is one of the ways to do it. Latest Missouri gas tax plan includes rebates for drivers.

The tax is distributed to the Missouri Department of Transportation Missouri cities and Missouri counties for road. 25 cents in 2022 5 cents in 2023 75 cents in 2024 10 cents in 2025 and then 125 cents in 2026 and. Gas costs have risen about 30 cents per gallon in the past month and everyone is looking for a way to save money.

Instructions for Completing Non-Highway Motor Fuel Refund Claim. Missourians can request a refund of the Missouri motor fuel tax increase paid each year. The tax is passed on to the ultimate consumer purchasing fuel at retail.

1 2021 Missouris current motor fuel tax rate of 17 cents per gallon will increase to 195 cents per gallon. Becky Ruth chair of the House Transportation Committee. LOUIS In Missouri were paying more at the pump these days than we have in a long time and that includes 17cents per gallon on a gas tax.

1 but Missourians seeking to keep that money in their pockets can apply for a rebate program. Under Ruths plan the gas tax would rise by two cents per gallon on Jan. On October 1 2021 Missouris motor fuel tax rate increased to 195 cents per gallon.

The tax refund only applied to the new 25 cents per gallon tax increase and not Missouris existing 17 cents per gallon gasoline tax. Did you know you can get a refund on that gas. The State of Missouri currently has one of the lowest gas tax rates in the country at 17 cents per gallon.

For most Missouri drivers the tax is refundable. Vehicle for highway use. 1 2021 through June 30 2022.

The bill includes a refund program for highway vehicles. Individuals who drive through or in Missouri could receive a refund for the increased gas taxes paid under a new plan put forth by Rep. Missouris first motor fuel tax increase in more than 20 years takes effect on Oct.

5-cent fuel tax increase that went into effect. The tax which was signed into law by Gov. Theres a new tool to help you save on the 2.

You may be eligible to receive a refund of the 25 cents tax increase you pay on Missouri motor fuel if. This bill allows purchasers of motor fuel for highway use to request a refund of the Missouri motor fuel tax increase paid annually. There is a way for Missourians to get a refund by submitting their receipts.

Refund claims must be submitted on or after July 1st but no later than September 30th following the fiscal year in which the tax was paid. Around that time the Missouri DOR announced Missourians might be eligible for refunds of the 25 cents tax increase per gallon paid on gas purchases after Oct. Use this form to file a refund claim for the Missouri motor fuel tax increases paid beginning October 1 2021 through June 30 2022 for motor fuel used for on road purposes.

Missouri receives fuel tax of 17 cents a gallon on motor fuel gasoline diesel fuel kerosene and blended fuel from licensed suppliers on a monthly basis. The state also hasnt had a gas tax increase in 25 years. Form 4923 must be accompanied with a statement of Missouri fuel tax paid for non-highway use detailing the motor fuel purchased.

Retained in the Missouri Department of Revenues files. The state announced possible refunds of the 25 cents tax increase per gallon paid on gas. Missouri has one of the lowest gas taxes in the country and this money would pay for things like infrastructure.

The information will be. It will go up 25 cents every year through July of 2025 when the tax will be ten cents higher than it is now at 295 cents per gallon. There is a way for Missourians to get that increased tax money back though.

The state will incrementally increase the gas tax by 25 cents annually with the funds earmarked for road and bridge repairs. Instructions for completing form. Missouri resident Michael Cromwell said the increase in gas prices is really painful to hear and he encourages Missouri.

Fuel bought on or after Oct. However not many people use this benefit due to complicated procedures. In October Missouri increased its statewide fuel tax from 17 cents per gallon to 195 cents per gallon.

/cloudfront-us-east-1.images.arcpublishing.com/gray/UEKA5DRH4VEE7DDH7MZ67VRQIY.jpg)

Waiting For Your Tax Refund Irs Says Select Returns May Take Several Weeks

Gas Prices Explained Gas Prices Infographic Social Media Infographic

How New Kansas Laws Affect What You Pay In Property Taxes

Here S The Average Irs Tax Refund Amount By State

Missouri Department Of Revenue Creating Refund Claim Form For Gas Tax

Avoid 6 Mistakes That Will Delay Your Irs Tax Refund

Irs Tax Refund Delays Persist For Months For Some Americans Abc7 Chicago

Maximizing Tax Deductions For The Business Use Of Your Car Business Tax Deductions Tax Deductions Small Business Tax Deductions

It S Tax Season Use Your Refund To Jump Start Your Down Payment Savings Keeping Current Matters Tax Season Tax Refund Down Payment

Pin By Jared Peterson On Lyft Business Tax Deductions Small Business Tax Deductions Tax Deductions

What If Your Tax Refund Is Wrong Fox Business

Stimulus Check Missing Some Waiting On 2nd Payment And Last Year S Tax Refund Wonder If Problems Are Related 6abc Philadelphia

How To Get A Missouri Gas Tax Refund As Gas Prices Increase

Here S The Average Irs Tax Refund Amount By State

Nomogastax App Gives Missourians The Option To Get Their

Missouri Gas Tax Refund Form 4925 Fill Online Printable Fillable Blank Pdffiller

My Tax Refund Why Is It So Small Moneysmart Blog Tax Refund Cool Things To Buy Electric Pen

Keep Your Receipts Missourians Can Get Refunds On Gas Tax Increase State News Komu Com

Pin By Harrison Millard On Investing In 2022 Electron Configuration Element Symbols Earth Elements